What Are Wimbledon Debentures?

Wimbledon Debentures offer an exciting, prestigious opportunity to secure the best seats alongside exclusive privileges at the world’s most famous tennis tournament Wimbledon, The Championships, held annually at the All England Lawn Tennis and Croquet Club (AELTC or simply All England Club), in the namesake district of Wimbledon, London.

These “Debentures” are a special form of financial instrument (asset), which are issued by the All England Club, granting the holder a range of privileges at The Championships (Wimbledon), including an entitlement to seats in the lower rows or middle tier of either the Centre Court (rows A-N) or No.1 Court (rows A-Q). Debenture allocated seats remain the same throughout the duration of a single year of The Championships, but will change yearly.

Debentures themselves are a debt instrument, akin to a bond, with the key difference of not being backed by collateral, meaning the instrument is backed only by the reputation of the offering organisation, which in this case is the The All England Lawn Tennis Ground plc.

Wimbledon Debentures are issued by the All England Club approximately every five years, each offering the holder the right to a ticket for a specific seat in either the Centre Court arena, or No.1 Court for every day of the Wimbledon Championships, for the duration of the debentures series, which typically covers five consecutive tournaments, or five years (till the next series of Debentures are offered). For instance, the current series of Centre Court debentures cover the 2021 – 2025 period, while the No.1 Court debentures cover the 2022 – 2026 period.

The Legal Status of a Wimbledon Debenture

The Wimbledon Debenture falls under the definition of a Qualifying Corporate Bond or a QCB. It is important to note that QCB’s are exempt from tax on chargeable gains, which may increase the debentures attractiveness with the consideration of Capital Gains Tax.

A Wimbledon Debenture may effectively be seen as a loan made by the debenture holder to the All England Lawn Tennis Ground plc, in the form of a nominal amount and a non-repayable amount, subject to VAT.

Wimbledon Debenture Transferability and Ticket Reselling

One of the key features of Wimbledon Debentures is their transferability, which include not only the debenture itself, but the associated ticket. As a financial instrument, Wimbledon Debentures are transferable assets, meaning they may be sold on the secondary market (privately or through specialised brokers).

Additionally, Wimbledon Debenture holders have the right to resell any of the tickets they hold entitlement to. This makes Wimbledon Debentures a potentially lucrative investment through ticket reselling, as the resale value of these tickets are often much higher than the face value they’re purchased for by debenture entitlement as demand for Wimbledon tickets are incredibly high, debenture tickets more so due to their associated premium seating and associated privileges.

Why Buying Wimbledon Debenture Tickets at Resale Is a Great Idea

Thanks to the reselling of Wimbledon Debenture entitled tickets their are no shortages of opportunities to experience Wimbledon in the best way possible, alongside all privileges offered by the All England Club, without the need of fronting the high-cost associated with the Wimbledon Debenture itself.

These tickets offer opportunities to experience the magic of Wimbledon, in a once-in-a-lifetime fashion with many advantages over regular tickets such as the exclusive access to the best seats, luxurious amenities and exclusive facilities (including lounges, restaurants, bars, parking, and toilets), high-class social opportunities, all of which also make for an incredible gift and unforgettable experience.

Fortunately for you, Aceify offer a safe, trustworthy place to purchase Wimbledon Debenture tickets from verified clients, so you can see the best games, in the best seats. And we really mean the best games; we have the knockout rounds, quarter finals, semi finals, and even the finals.

The Financial Side Of A Wimbledon Debenture Investment

While Wimbledon Debentures are often viewed from the perspective of their utility and lucrative perks, they also represent a significant financial investment, as they are by definition a financial instrument, an asset. With this, it’s important to remember that their is a real financial commitment that is needed to be made, and buyers must remain informed when purchasing Debentures.

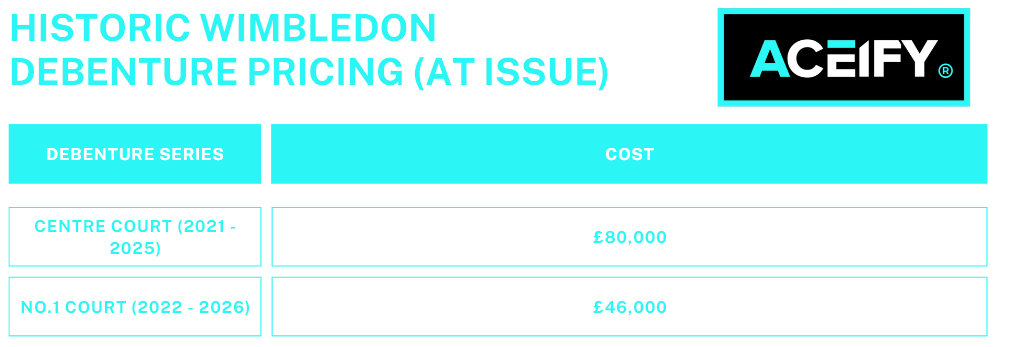

Becoming a Wimbledon Debenture holder starts with a substantial upfront investment. It is only natural that a financial instrument with such unique perks, and a potentially lucrative upside is quite difficult to obtain. For the All England Club’s Centre Court Wimbledon Debenture, lasting 2021 – 2025, the price at issue was a substantial £80,000, while the No.1 Court Debenture for the series covering the period 2022 – 2026 fetched a sizeable £46,000 at issue.

Historic Wimbledon Debenture Prices for Centre Court 2021-2025 Series and No.1 Court 2022-2026 Series

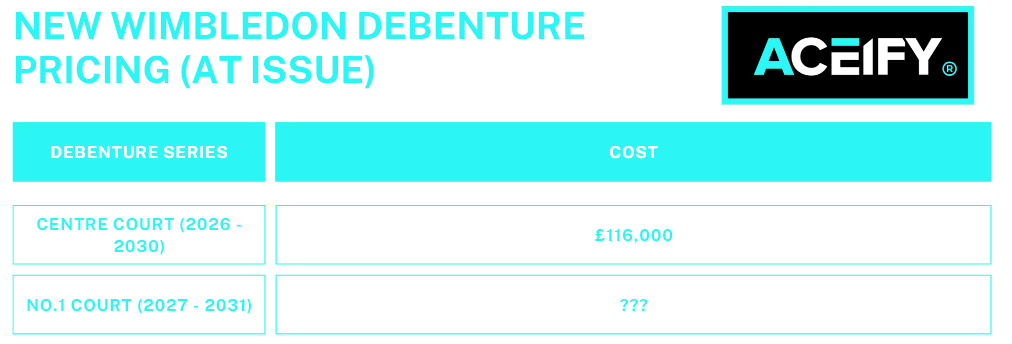

Periodically, just before the expiration of the ongoing Wimbledon Debenture series, the next series of debentures are announced with applications/ declarations of interest opening . Typically, with every new series, the price increases. For instance, the next Centre Court Debenture series (2026 – 2030) has been issued at a total price of £116,000, a £36,000 increase on the previous series. The No.1 Court series (2027 – 2031) is yet to be announced, so we don’t yet have a price, however it’s likely we’ll see an increase of at least 46% (in line with the Centre Court Debenture increase).

New Wimbledon Debenture Prices for Centre Court 2026 – 2030 Series and No.1 Court 2027-2031 Series

How Debenture Holders May Get a Return on Investment

Due to their exclusivity, Wimbledon Debentures are highly sought after. This demand may lead to increase in their market value over time, but importantly the inverse may happen, as with any other financial instrument. With this increase in market value, the debenture holder may chose to sell their Wimbledon Debenture on the secondary market, with verified parties. Wimbledon Debenture holders may also seek to resell their debenture entitled tickets for a price higher than the face value.

How Are the Funds from Wimbledon Debentures Used?

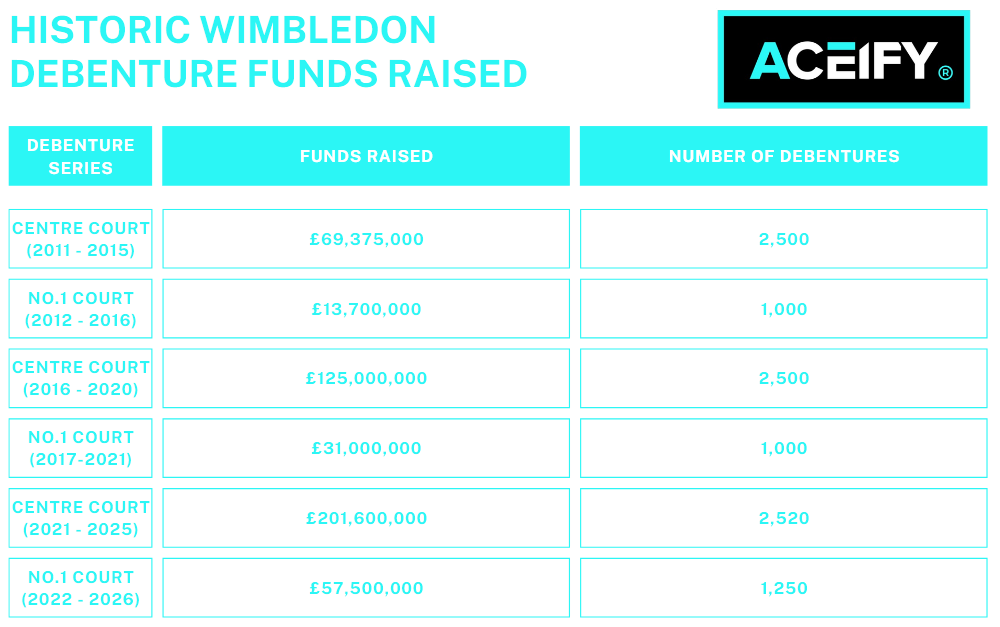

Debenture raised funds play a crucial role in the maintenance and enhancement of Wimbledon’s The Championships. These funds play an integral role in the ongoing development, improvement, and long-term sustainability of the tournament and venue the All England Lawn Tennis Club. Wimbledon Debentures raise an incredibly significant amount of money, with the Centre Court Debenture (2021 – 2025) raising an eye watering £201,600,000, and the No.1 Court Debenture raising £57,500,000.

Historic Wimbledon Debenture Funds Raised for For Years 2011 – 2026

Infrastructure Development and Upgrades

Foremost, the funds made available by the Wimbledon Debenture scheme are used for infrastructure improvements at the All England Lawn Tennis Club. These investments are made to ensure that facilities for the world’s most prestigious tennis event, The Championships, remain world-class, while continuously improving the visitor and player experience.

One of the most notable projects funded by debenture sales was the installation of the retractable roof over Centre Court, completed in 2009, for around £100m. Following the success of the Centre Court roof, a similar project was undertaken for No.1 Court, completed in 2019, costing around £70m, which also added extra seating to Wimbledon’s second largest arena.

Among other improvements, Wimbledon Debenture funds have contributed to the ongoing refurbishment of the All England Lawn Tennis Club’s facilities such as seating, restaurants, lounges, toilets, and the implementation of sustainability initiatives such as energy efficiency improvements, water conservation, and waste management.

Financing of Tournament Operations

Wimbledon’s reputation is something the tournament organisers and the All England Club take seriously. With this, debentures see a significant boost in funding Wimbledon’s tournament operations, such as technological advancements in the form of broadcasting facilities, tracking and refereeing systems, and more. Other operational improvements include significant investments in tournament security and safety, through staff and advanced security systems, as well as improvements to player amenities, such as locker rooms, practice courts, rest areas, and more.

Grassroots Charity Initiatives and Wimbledon Community Programmes

The Wimbledon Foundation’s 10 Year Anniversary Update

The All England Lawn Tennis Club have thoroughly demonstrated their commitment to their local area, tennis as a sport and as a grassroots movement. Through Wimbledon Debentures, they have financed countless local community programmes, provided funding for local schools and tennis clubs, and committed a significant portion of funds to local and national charities.

How to Purchase Wimbledon Debentures

As we’ve clearly demonstrated, Wimbledon Debentures offer an exciting, unique experience and investment opportunity. Their are two ways you can purchase a Wimbledon Debenture, and this is either directly from the All England Lawn Tennis Club as new debentures are issued, or from the secondary market in which you purchase from current debenture holders.

Buying Wimbledon Debentures Directly

When a new series of debentures is issued, interested buyers can purchase them directly from the All England Lawn Tennis Club (AELTC). This process is typically structured as follows:

- Registration and Application: Potential buyers must register their interest through the official Wimbledon Debentures website or through direct contact with the AELTC. Once registered, they will receive updates and application forms when new series become available.

- Allocation Process: Since demand often exceeds supply, the AELTC may allocate debentures based on a lottery system or other criteria to ensure a fair distribution among interested parties.

- Payment and Issuance: Upon successful application, buyers must complete the purchase by making the full payment for the debentures. The AELTC will then issue the debenture certificate, which entitles the holder to the associated benefits and tickets.

Buying Wimbledon Debentures from the Secondary Market

For those unable to acquire Wimbledon Debentures during the initial issuance period, the secondary market offers a viable option. In the secondary market purchasers buy the debentures from current holders who are looking to sell.

- Authorised Brokers: The AELTC endorses certain brokers to handle the resale of debentures. If you are unsure which secondary market to chose, it is always viable to look at 2nd party or approved brokers.

- Private Sales: Debentures can also be bought through private arrangements directly from current holders. This requires careful negotiation and due diligence to ensure a fair and legal transaction.

- Marketplaces and Auctions: Specialised marketplaces and auction platforms may list debentures for sale. These platforms provide a transparent bidding process, often at a premium due to the high demand.

How To Purchase Wimbledon Debenture Tickets

You can also purchase the tickets entitled through the purchase of a Wimbledon Debenture. These are done through resale markets, in which Wimbledon Debenture holders will sell their allocated tickets. These markets can be an incredible opportunity for non debenture holders to experience Wimbledon in the best way possible. If you’re looking for safe, trustworthy way to get debenture tickets for the best matches at Wimbledon 2024 try Aceify.me.

Frequently Asked Questions (FAQ)

What happens if I (A Debenture Holder) can’t attend a day at Wimbledon?

If you can’t attend a day, you can sell your debenture tickets on a secondary market, like Aceify.me. Given their premium nature, these tickets often attract high demand, particularly for the final rounds of the tournament.

Can I access both Centre Court and No. 1 Court with a single debenture?

No, each debenture is specific to either Centre Court or No. 1 Court. To access both courts, you would need to hold debentures for each.

How much do Wimbledon Debentures cost?

The cost of Wimbledon Debentures varies depending on the court and the issuance series. For example, the 2021-2025 Centre Court debentures were issued at £80,000 each, while the 2022-2026 No. 1 Court debentures were priced at £46,000. Prices can fluctuate based on demand and market conditions in the secondary market, as well as the requirements of the All England Tennis Club. The next set of Centre Court Debentures, ranging 2026 – 2030 are priced at £116,000

How often are new Wimbledon Debenture series issued?

New series of Wimbledon Debentures are typically issued every five years. Each series provides holders with tickets for every day of The Championships for the duration of the five-year period. It’s important to stay updated with the AELTC for announcements regarding new series issuances.